Risk will always have a place in the contracting process. If strong contract management is established, it plays an integral role in creating and developing risk management strategies to identify, assess, and mitigate risks associated with the contract. Businesses typically manage a diverse range of contracts, from sales to supplier agreements, each varying significantly in type and duration. How do you ensure contract risks are properly identified and managed successfully throughout a contract’s life? This article will explore some of the most common types of contract risks and offers guidance on how to create policy that helps your company work within acceptable levels of risk and ensure the success and stability of the contract.

What is a Risk?

One way to look at a risk is that it is an uncertain event or situation that, if it occurs, may affect the project or program in some manner. Differentiate that from an “Issue” which is a risk which has occurred and will need to be resolved in some manner. Our focus of this article is on risks since if risks are identified before the project begins, plans can be developed to manage and mitigate the risks proactively.

Risks can generally be broken out into three categories.

- Contract Risk – This involves identifying risk in the areas of contract creation and contract terms. A few examples include:

- Delivery/milestones with the risk of not meeting the due dates

- Strict or absolute obligations (contractual obligations which are absolute and do not depend on a failure to exercise heightened reasonable care), thereby increasing liability (examples: “take all precautions” or “continuously inspect work”)

- Regulatory compliance burden

- Poorly designed and described Statement of Work

- Improper change management

- Financial Risk – Financial risk involves identifying areas of potential financial loss to a project or an account. A few examples include:

- Currency fluctuations if payments are made in foreign currency

- Customer stability where a customer may become financially unstable at any point in the relationship

- Risk associated with development and management of comprehensive actions on budget, forecasting and mitigation, owners and dates

- Year-over-year built-in price decreases included in the contract pricing, or guaranteed savings clause in the contract

- Actual cost run rate for the project or account is greater than bid model at time of contract execution

- Operational or Service Risk – This involves identifying technical and project performance risks along with scheduling and cost impacts. A few examples include:

- Dependency on the use of third-party products or services

- Failure to have sufficiently skilled and experienced resources to effectively manage the project

- Inability to meet the timeline or delivery date

Understanding Contract Risk

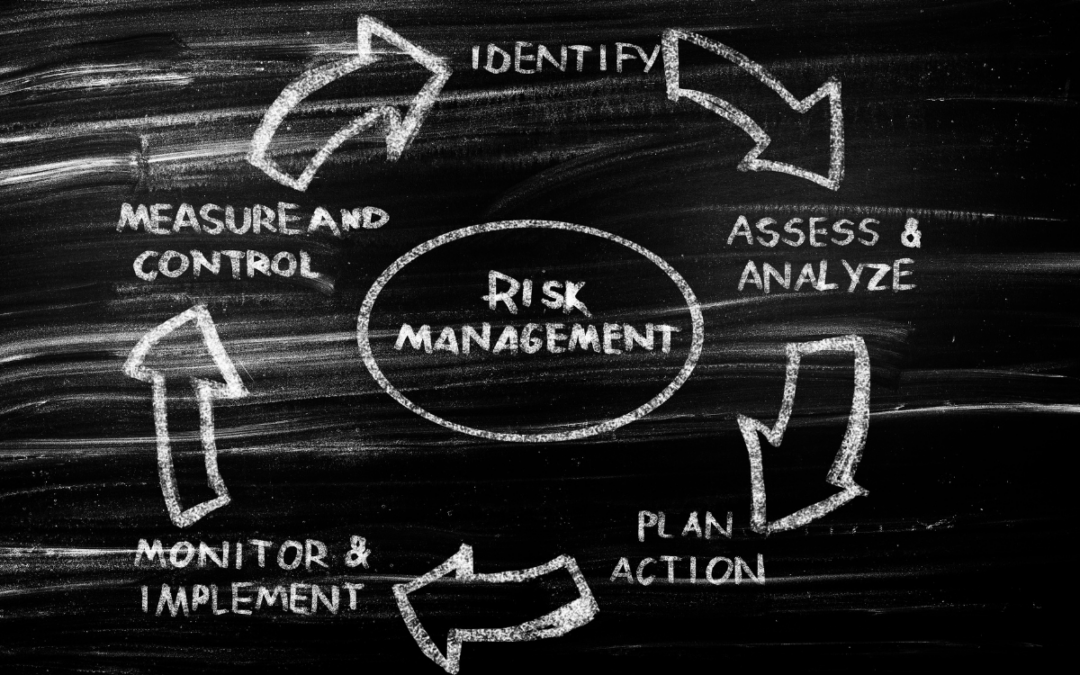

Every project and contract come with its inherent risks. The way you handle these risks is crucial in minimizing losses and maximizing profitability. Here are some key risk management strategies that together create a robust approach to managing risks effectively.

- Identify the Risks. A critical step in risk management is to accurately identify and define the risk with a clear risk statement. During this phase, risks are uncovered and classified by type, ensuring that the right team is engaged to manage and resolve them effectively. Utilizing a Risk Register is an essential tool for tracking and managing these risks, which can emerge at any point in the contract lifecycle.

- Analyze the Risk. Risk analysis involves evaluating and quantifying risks, along with assessing the probability and potential impact of each. This enables the selection and development of the most suitable management strategy, such as Acceptance, Avoidance, Mitigation, or Transfer (see further details under “Manage” below). Employing a Risk Analyzer tool can be extremely beneficial in objectively determining the significance of risks to the project or contract.

- Managing the Risk. In this stage, start by evaluating your risks, prioritizing those with the highest-ranking risks to develop your risk management plan. This includes crafting strategies, preventive measures, and contingency plans. There are four primary approaches to effectively managing risk:

- Acceptance – This method is used for low level risk. Risk acceptance is the decision not to make any changes to address a risk generally because the risk level is insufficient to justify the cost of risk mitigation, but the risk is not easily avoidable. These types of risks should still be quantified with a contingency plan should the risk occur.

- Avoidance – Risk avoidance is the strategy whereby the project approach is modified to eliminate the possibility of the risk occurring. This can be done through a change in management approach, technical approach, staffing solutions, or other ways where the project will not be placed in a position where the risk could materialize.

- Transferal – Risk transferal involves transferring the risk to another, such as a subcontractor. Note that risk transferal may create new risks that must also be managed, such as the risk of the subcontractor not performing.

- Mitigation – Most risks are managed through mitigation. Mitigation is taking actions to minimize either the likelihood of occurrence, the impact to the project, or both. Risks may have associated costs which must be evaluated and incorporated.

- Closing the Risk. The ultimate goal of risk management is closure of the risk. Successfully managing a risk often leads to it being Avoided or Mitigated. A risk is considered closed as “No Further Action” when there are no viable additional steps to mitigate its impact. As appropriate and in consultation with stakeholders, a risk can be Withdrawn at any time in the process if it ceases to be a risk. A realized risk is closed as “Converted to an Issue” when the risk materializes.

In Summary

In the realm of contract management, the practice of identifying and assessing risks should be continuous and adaptable, reflecting the rapidly evolving and intricate nature of commercial relationships. It’s important to recognize that unaddressed risks can escalate into issues, and unresolved issues may lead to disputes. Therefore, managing risks effectively and ensuring their resolution is crucial. How do you approach risk management of a particular deal? We’d love to hear your thoughts. Contact us today.